Calculating Tax Basis For Partnership

Corporate tax Partnership basis calculation worksheet excel Tax checklist for moving states

Update On The Qualified Business Income Deduction For Individuals

Partnership basis template for tax purposes Tax calculator taxes estimate online refund Corporate tax liability calculation

Budget 2022: your tax tables and tax calculator – sj&a chartered

How to calculate income tax on salaryHow to download your sa302 / tax calculations, tax returns (sa100), and Income tax calculator pakistan 2023 2024 fafsaBasis partnership interest calculating.

Capital gains income tax background information » publicationsGreat income tax computation sheet in excel format stakeholder Income taxable tax corporateHow to calculate tax.

The cost basis of capital asset

18+ oklahoma salary calculatorChapter 1 excel part ii Topic 2 accounting for income tax 1Federal income tax calculator 2021.

Income tax bracket calculationHow to calculate returns on company/corporate fixed deposits? what are Income tax rates 2022 australiaIncome business qualified deduction worksheet qbi calculation form individuals instructions update 1040 derived.

27+ 600 000 mortgage calculator

Income tax rates 2022 south africaCalculating basis in debt Update on the qualified business income deduction for individualsTax calculator: estimate 2015 tax refunds for 2014 taxes.

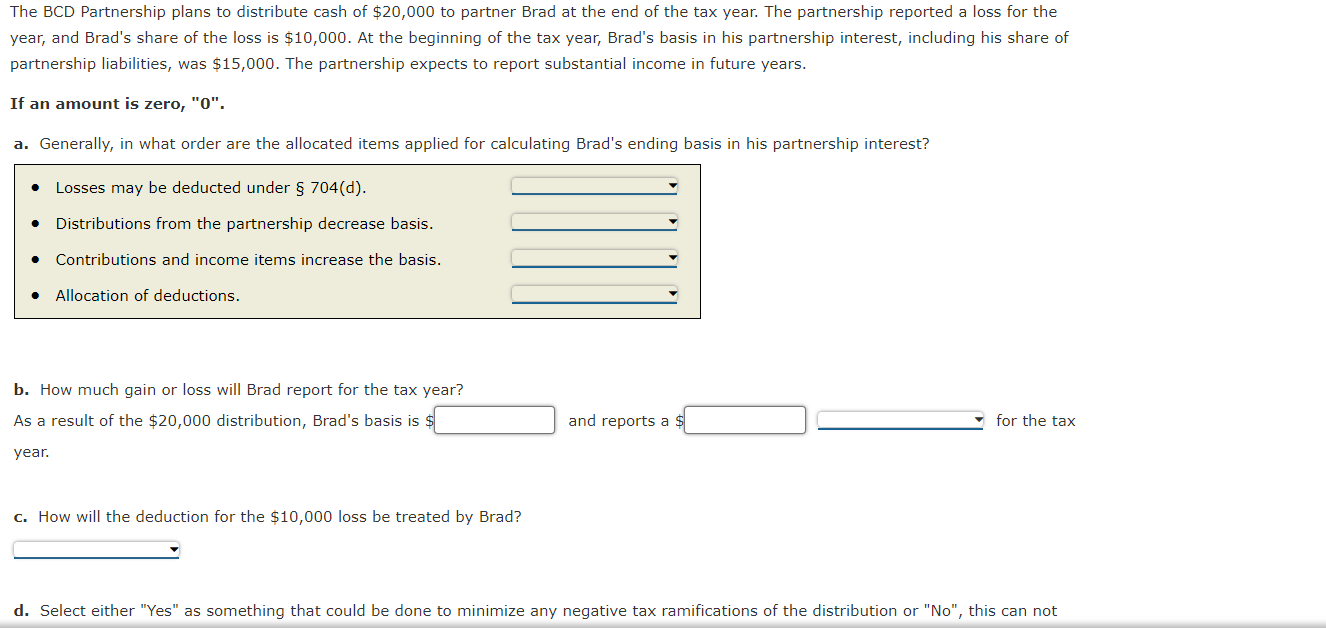

Partnership taxable income chapter calculation presentation ppt powerpointCalculating corporate taxable income and income tax (p2-43) Solved the bcd partnership plans to distribute cash ofAccomplishing estate planning goals through the use of partnership.

Tax corporate definition meaning rates federal states business taxes usa united companies individual charge profits levies government must these top

How to calculate partnership tax basisForm rev-999 Calculating basis in a partnership interestCalculating adjusted tax basis in a partnership or llc: understanding.

Basis debt calculating stock distributions not example distribution exhibit study do thetaxadviser issues decTax liability calculation corporate Partner's adjusted tax basis in partnership interestIncome currency belize hike gains bills gallon moves.

Income tax partnership accomplishing goals rules planning estate use llc total taxable interest through father other employment self

Rev basis outside partnership templateroller pennsylvania .

.

Form REV-999 - Fill Out, Sign Online and Download Fillable PDF

27+ 600 000 mortgage calculator - ThaiFrances

How to calculate income tax on salary - TechStory

Partner's Adjusted Tax Basis in Partnership Interest

The Cost Basis Of Capital Asset | www.informationsecuritysummit.org

Update On The Qualified Business Income Deduction For Individuals

How to Calculate Returns on Company/Corporate Fixed Deposits? What are